Budget and Forecast – What is the Difference?

What is a Budget?

A budget is a predefined plan for future revenues and expenses over a specific period (typically a year) and serves as a reference framework for the business, helping to manage and control finances. The budget is established in advance and acts as a target for resource planning and activity prioritization. It is also used to measure how well the business adheres to its plan.

What is a Forecast?

A forecast, on the other hand, is an updated estimate of how financial performance is expected to develop based on current data and trends. A forecast provides a realistic view of the future and helps businesses adapt to changing conditions. It can be updated regularly throughout the period, such as monthly or quarterly. Additionally, a forecast is used as a tool to compare with the budget to determine if the business is on the right track and to adjust strategies if necessary.

How Do They Differ?

Both budget and forecast are important because they serve different but complementary roles in financial management and decision-making. While the budget provides a clear plan for revenues and expenses over a specific period, the forecast offers an up-to-date view of reality that enables flexibility. In this way, one can quickly respond to deviations from the budget. In summary, both budget and forecast are essential tools for companies to plan long term while also acting flexibly in the short term.

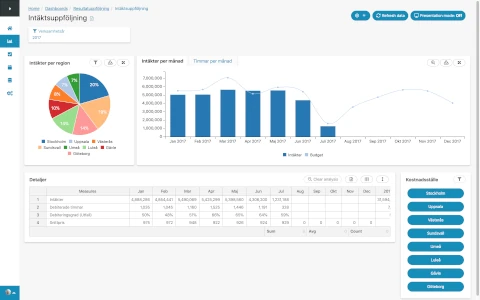

Budget and Forecast with Cumulus BI

Book a demo today!

CBI has made reporting much easier and we can now get figures out quickly and look at them from different perspectives. The budgeting and forecasting part have been by far the biggest boost.